Wells Fargo and Company and the T.D. Jakes Gathering, which incorporates the Dallas megachurch minister’s various undertakings, are consolidating over the course of the following 10 years determined to revive neighborhoods and driving monetary open door.

Wells Fargo said it could give as much as $1 billion in capital and supporting to the work, as well as awards from the Wells Fargo Establishment.

“This essential organization goes past an oddball capital speculation and highlights our proceeded with obligation to different and comprehensive networks,” expressed Chief of Wells Fargo Charlie Scharf.

The cash will initially go towards Jakes’ latest land adventure beyond Atlanta. Last year, Jakes’ land bunch started buying almost 100 sections of land of Post McPherson, a notable previous armed force base, with plans to make a blended use local area.

The Wells Fargo Establishment and T.D. Jakes Establishment additionally plans to drive capital into low-and moderate-pay networks to increment homeownership and make organizations in a few urban communities including Atlanta, Chicago and Dallas.

With the principal project close to Atlanta, the task is set to focus on green space alongside blended pay lodging and a variety of single-family homes, condos and lofts, close by merchants and medical care.

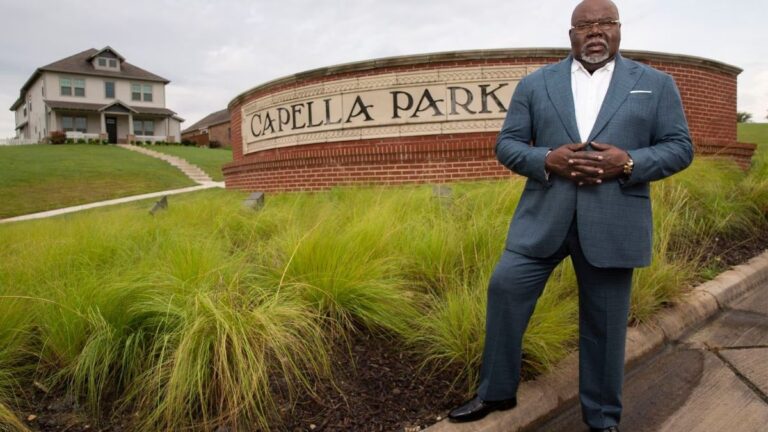

Working out this sort of land improvement is definitely not another undertaking for the minister turned-money manager. Situated on an uncommon rich slope a short ways from downtown Dallas is Capella Park, an expert arranged 400-section of land area financed by one of Jakes’ not-for-profits, constructed only a mile from his megachurch, The Potter’s Home.

Components of the Stronghold McPherson improvement will be designed according to Jakes’ Dallas multigenerational local area.

The relationship between the bank and the famous Dark minister comes after a huge number of separation and work infringement settlements over the past ten years that tested the bank’s standing with generally underestimated gatherings.

In 2012, Wells Fargo consented to pay a $184 million settlement to property holders after clients claimed the bank oppressed qualified Dark and Latino borrowers in its home loan loaning from 2004 through 2009.

All the more as of late, the bank consented to pay $7.8 million in back wages and premium to determine charges of recruiting segregation in 2020, after the U.S. Branch of Work’s Office of Government Agreement Consistence Projects asserted Wells Fargo victimized in excess of 34,000 African-American candidates and many female up-and-comers.

As the organization attempted to move away from past embarrassments, before the end of last year the shopper banking monster was requested to pay $3.7 billion in fines and discounts to clients by U.S. government controllers, after The Customer Monetary Insurance Agency drilled down a wealth of purchaser monetary regulation infringement, from unlawful expenses and premium on vehicle advances and home loans, as well as wrongly applied overdraft charges against reserve funds and financial records.

The agency said the bank’s awful conduct influenced in excess of 16 million clients.

Throughout the course of recent years, Wells Fargo has placed enormous cash into correcting its connections. The organization shut $10 billion in supporting through its local area loaning and venture bunch and $5.7 billion in funding through its gathering pointed toward creating reasonable lodging and networks.

Jakes called the organization problematic in its capacity to carry late change to Dark and earthy colored networks across the U.S.

“We perceive the requirement for Presidents like Charlie Scharf twisting the circular segment and point of Wells Fargo toward amending foundational imbalances,” Jakes said. “We are focused on guaranteeing extra open doors really reach as numerous areas of need that we can impact.”